DIY Builds

DIY Builds

DIY Builds

DIY Builds

Photo: John Diez

Photo: John Diez

With a loan backed by the government like an FHA loan, you can qualify for a mortgage even with a 500 credit score. It might be tempting to buy a home as soon as possible, but it's better to take the time to assess available options and interest rates while you start shopping for a loan.

What You Can Store In A Shed Gasoline. Gasoline won't freeze like other liquids. ... Propane Tanks. Propane is another fuel that is not ill-...

Read More »

SIZE REGULATIONS IN NSW There are no more than 2 structures per property. In residential zones it can be no larger than 20sqm. If its in rural...

Read More »

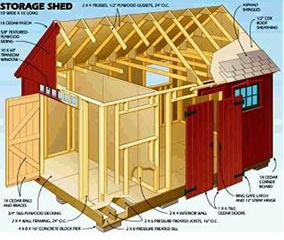

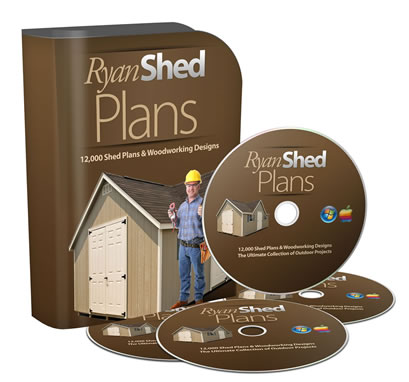

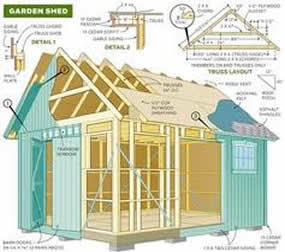

These are! They guide you every step of the way to complete your dream shed.

Learn More »The best home loan option for you if you have bad credit depends on how low your score is. If your score is below 600, you probably should look into an FHA loan or VA loan. Of course, the best option is to work on repairing your credit score before you submit a mortgage application. While this is not the answer borrowers want to read or hear, it’s the most practical and can save you thousands in interest payments. Not only will you have more mortgage options, but you might be able to get your loan with a lower income requirement and down payment. Of course, as stated above, if you have a score of 500 or below, you probably won’t be able to do anything except wait until you increase it. Also, if you’re looking to buy a house with a bankruptcy on your credit, you will need to wait at least 2 years before a lender will start considering you for a new mortgage. You can take the necessary steps to grow your score by understanding the following: Payment history: Your payment history is responsible for 35% of your score. This is the main reason people are continually saying “pay your bills on time” regarding your credit score. Credit utilization: The amount of credit you are currently using is also known as your credit utilization and is responsible for 30% of your score. The more credit you’re using, the higher your credit utilization, the lower your score can become. It would help if you looked to keep your total credit usage under 30%. Age of credit history: This is most often referred to as your “average age of accounts” and is one of the few factors you have almost no control over. Your credit history is basically the age of your oldest credit account, new credit accounts and the average ages of all the accounts on your credit report. The length of your credit history makes up 15% of your score. Credit mix/types of credit: When you look at your report, you’ll notice that there are a few different types of credit on your report. Those can be revolving credit (like credit cards) or installment loans (like car loans or personal loans). Having a mix of credit is a good thing for your score, and it is responsible for 10% of it. Amount of new credit: Having an account less than 6 months old is usually considered having new credit. Your score will be impacted whenever you add a new account because it will give you a hard inquiry and decrease your average age of accounts. Be mindful when applying for new credit as it contributes to 10% of your overall score.

Create the Cut List Create a view of the assembly and create a parts list for it. Select the part list and apply the “Cut List” style to it. Right...

Read More »

How to Heat a Shed Without Electricity Make Sure It's Well Insulated. Let Some Sunlight In. Build A Solar Window Heater. Portable Propane Heater....

Read More »

12 Roses – gifting someone you are fond of with 12 single roses is a simple way to ask them to be yours. 13 Roses – the meaning of roses when...

Read More »

Wood treatments such as paint can really save the day when it comes to prolonging the life of your garden shed. Waterproof shed paint resists water...

Read More »

While getting an insurance quote won’t affect your credit score, applying for any type of new credit will. Having too many hard inquiries on your credit is not a good thing. When applying for any type of financial transaction that requires a credit pull, always check if it’s a hard or soft pull. Avoid doing anything requiring a hard pull close to when you apply for a mortgage.

The cost of siding a shed with board-and-batten depends on the shed dimensions, plus the widths of the planks used, and the grade of lumber – even...

Read More »

So what's our formal opinion on 2 x 4 scrap lumber bits for firewood? Its fine for home use, backyard use, and local campgrounds when permitted....

Read More »

These are! They guide you every step of the way to complete your dream shed.

Learn More »

If a report includes two or more indications of value that are significantly different from each other and they are averaged to get to the...

Read More »

Code and common sense both dictate that Romex shouldn't be left exposed but must run through conduits. Mar 16, 2021

Read More »