DIY Builds

DIY Builds

DIY Builds

DIY Builds

Photo: Mikhail Nilov

Photo: Mikhail Nilov

The 7 year rule No tax is due on any gifts you give if you live for 7 years after giving them - unless the gift is part of a trust. This is known as the 7 year rule. If you die within 7 years of giving a gift and there's Inheritance Tax to pay on it, the amount of tax due after your death depends on when you gave it.

The top five projects that add the most dollar value to a sale in 2022 are refinishing hardwood floors, installing new wood floors, upgrading...

Read More »

Poplar is good for firewood because it lights quickly when dry and will warm your house well during the shoulder seasons. Poplar is a relatively...

Read More »

Inheritance Tax may have to be paid after your death on some gifts you’ve given. Gifts given less than 7 years before you die may be taxed depending on:

Following more than a year of intense speculation as to whether the Tesla and SpaceX CEO is really calling a tiny, very cheap, prefabricated house...

Read More »

Hydrogen peroxide kills mold spore on contact by breaking down proteins and DNA. It's normally used to clean mold on porous and non-porous...

Read More »

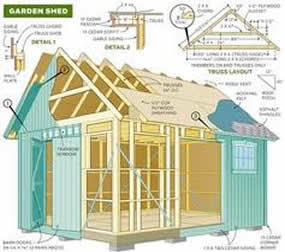

These are! They guide you every step of the way to complete your dream shed.

Learn More »You can give as many gifts of up to £250 per person as you want each tax year, as long as you have not used another allowance on the same person. Birthday or Christmas gifts you give from your regular income are exempt from Inheritance Tax.

Basic garage structures are not required to have foundation footings unless your lot slopes or has poor soil conditions. Most garages have a 4″...

Read More »

Chain-link fencing may not raise your property value, but you can purchase fencing materials from Shur-Way Building Center in Vancouver, WA no...

Read More »If you give something away but still benefit from it (a ‘gift with reservation’), it will count towards the value of your estate.

There is no one hard and fast rule on minimum stay policies that can be applied to all Airbnb vacation rentals. Some hosts opt for a 1-night...

Read More »

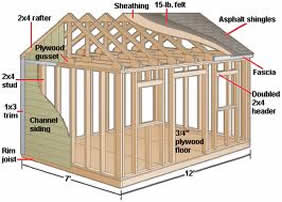

Generally speaking, a 12-foot-by-12-foot shed will suit a large yard, while an 8-foot-by-10-foot one is better for a medium-size yard. In selecting...

Read More »

A 2×6 can support up to 50 pounds per square foot of weight without sagging with a maximum span of about 12 feet when spanning a distance...

Read More »

Lock it to something secure and immoveable The solution, particularly for garages and sheds, is to fit a lock anchor. The best option is a heavy-...

Read More »