DIY Builds

DIY Builds

DIY Builds

DIY Builds

Photo: Juan Pablo Serrano Arenas

Photo: Juan Pablo Serrano Arenas

The median home price will rise to $385,800, an increase of only 0.3% from this year's level ($384,500), while home sales will fall 6.8% compared to 2022's level (5.13 million). 3 days ago

If you're going to bury an extension or power cord, even temporarily, you'll want to bury it in a PVC conduit pipe. Specifically, you'll need rigid...

Read More »

The cost of an asphalt driveway is typically cheaper than concrete, costing $2.00 to $4.00 per square foot. Asphalt prices tend to fluctuate with...

Read More »

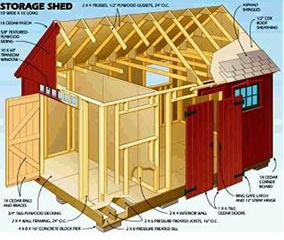

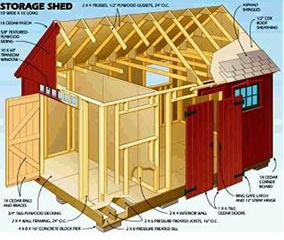

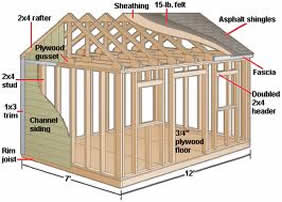

These are! They guide you every step of the way to complete your dream shed.

Learn More »Here's what some of the experts predict will happen in the housing market in the next five years. Some economists are more hopeful, but even those who predicted price increases through 2023 are changing their tune. For example, Freddie Mac's October forecast indicates 0.2% price decreases in 2023, a change from the previous quarter's estimate of 4% price increases. Experts are concerned about red flags in the housing market as the Fed attempts to keep inflation under control. Nobody knows how severe the correction will be, but economists are keeping an eye on the unpredictability of the housing market and aren't happy with what they're seeing so far. According to Zillow, the current typical value of homes in the United States is $357,589. Here is the summary of the housing market predictions for the next year as we approach the end of this year. Selma Hepp, interim lead of the Office of The Chief Economist at CoreLogic: Real estate activity and consumer mood regarding the housing market plummeted after the recent increase in mortgage rates above 7%. In October, home price increases remained close to single digits, and this trend is expected to persist through the rest of the year and into 2023. Some housing areas have experienced major recalibration since the spring price high and are projected to incur losses in 2023. Nonetheless, more deteriorating inventory, some relief in mortgage rate rises, and reasonably optimistic economic data may help eventually stabilize home values. The top economist at Realtor.com, Danielle Hale: In 2023, the housing market could feel more like a buyer's market than a seller's market after being in a sellers' market for several years. While the 22.8% increase in listings should be good news for buyers, it's mostly due to homes taking longer to sell due to tighter affordability. In 2023, the national annual median price for homes for sale is projected to rise by another 5.4%, which is less than half the pace seen in 2022. Even if a homeowner decides to sell their home, they will likely have a lot of equity in it. However, as buyers and sellers pull back from a housing market and economy in transition, we anticipate house sales to be significantly lower, down 14.1% compared to 2022. The rate of home sales in late 2022 is a good indicator of what the annual total for 2023 would look like. Chief economist and senior vice president of research at the National Association of Realtors, Lawrence Yun: In 2023 and beyond, the real estate market in Atlanta will be the one to watch as 4.78 million existing homes are sold at stable prices. The median home price will rise to $385,800, an increase of only 0.3% from this year's level ($384,500), while home sales will fall 6.8% compared to 2022's level (5.13 million). There's a chance that half of the country may witness price increases, while the other half will see price drops. Nonetheless, the markets in California may be an outlier, with San Francisco perhaps seeing price decreases of 10-15%. Following a 7% increase in 2022, rents will go up by 5% in 2023. In 2023, the foreclosure rate will be lower than ever before, accounting for less than one percent of all mortgages. This is less than half the average historical rate of 2.5%, therefore the 1.3% GDP growth will be a significant slowdown. As the Fed lowers the pace of rate hikes in an effort to contain inflation, the 30-year fixed mortgage rate will fall to 5.7% in late 2022 from its peak of over 7% at the time. This is significantly lower than the pre-pandemic average of 8%. Taylor Marr, Associate Chief Economist at Redfin: Mortgage rates are expected to fall further in the new year as a result of taming inflation and expectations that the Federal Reserve would ease rate hikes in the next year, which will boost demand for house purchases. But demand is still well below its high, so it's too early to declare a comeback or even a recovery. We are keeping an eye on the job market for signs of sustained deceleration in price growth. Higher salaries and consequent price increases are one effect of a robust labor market like the one we're experiencing right now. A small increase in unemployment and/or slower economic growth would definitely help bring down mortgage rates even further, which seems paradoxical. If this trend continues into 2023, the boost in demand seen thus far may be reflected in a rise in pending sales. Senior economist at Zillow, Jeff Tucker: The softening of the rental market has not yet resulted in any significant respite for tenants. There is hope, though, that prices will decrease in the coming months. Rent increases have slowed from a record 17.2% in February to 8.4% in November. Data like this is encouraging for renters hoping to sign a new lease in 2023, but they should still keep a careful eye on the market and move swiftly if they locate a rental that meets their needs and budget. Since rental rates are still higher than they were before the outbreak, compromise and adaptability will be required well into next year. Tenants with leases coming up for renewal should realize that they have greater leverage to negotiate this year and should look around at comparable rentals in the area before making a decision. United States home values have gone up 13.5% over the last twelve months and are predicted to rise by 1.2% by October 2023. Home values remained nearly flat from September to October (+0.1%), as buyers and sellers potentially settled on a new market equilibrium. The housing market forecast remained generally unchanged in October, as the housing market continued to slow amid rising mortgage rates and broader economic uncertainty. Zillow projects home values remain flat through the end of the year, and increase by 1.2% in the twelve months ending October 2023. Many sellers are waiting for the market to cool down, at least evidenced by the flow of new for-sale listings hitting the market, now down 23.9% from last year’s flow. Fewer homes are being listed for sale, which may force more listings to reduce their prices to match decreasing housing demand. These long-term housing predictions may change as the housing market rebalances and faces headwinds. Buyers and sellers face rising and fluctuating mortgage rates. Demand is capped and prices are lowered by affordability barriers at record highs. New listings are lower than a year earlier, supporting prices but limiting sales. As year-end approaches, the housing market faces considerable downside risks. Zillow expects home value growth to continue to slow over the coming months. Zillow’s home sales forecast now calls for 5.2 million existing home sales in the calendar year 2022. This forecast is up slightly from last month’s expectations for 5.1 million sales. The forecast is up following a better-than-expected reading on home sales in August. However, the housing market predictions for 2023 and the long term are bleaker. The recent reductions in mortgage applications and pending house sales indicate significant negative risks to home sales volume through 2023. Las Vegas (-2.3%) and Austin (-2.2%) saw the sharpest home value declines in October.

“While it may differ by local markets, a broad market crash is unlikely,” says Rob Cook, vice president of marketing at Discover Home Loans. Some...

Read More »

The legal and regulatory name for backyard houses is accessory dwelling unit, or ADU. However, there are dozens of names in circulation for ADUs,...

Read More »

These are! They guide you every step of the way to complete your dream shed.

Learn More »A drop in demand due to rising mortgage rates causes homes to stay on the market longer and slows price increases. Many would-be sellers are tied to low rates, making the switch to a more expensive mortgage difficult, and reducing inventories. This rebalancing gives wealthy purchasers more time to make decisions, less competition, and greater negotiation leverage than in recent years. The forecast for 5.2 million existing home sales in 2022, also reflects recent market changes and continued weakness in leading indicators of the metric. Homebuyers continued to be deterred by mortgage affordability problems, resulting in less competition and a larger supply of available houses. Since last year, the housing market has cooled dramatically, and homes are now staying on the market for much longer, whether they sell or not. Days on Zillow – a measure of the median amount of time a for-sale listing has been on the market – was 54 days as of the week of October 16, up from the series' lowest-ever recorded figure of just 19 days in early April and 38 days in the same week in 2021. At this rate, Days on Zillow will likely reach 68 by the end of the year, ten days higher than it was at the end of 2021. However, this expected level would still be significantly below pre-pandemic time on the market, demonstrating that some market competition exists, even as purchasers drawback in the face of affordability issues, owing in part to a slow influx of new for-sale listings. The pace of buying has slowed as well. The share of inventory that has been on the market for at least 60 days rose to 46% in mid-October. As rates, and thus mortgage payments, stay high, many potential buyers are being priced out of the market, and affordability will likely not be on their side any time soon. Sellers who list their home today could expect it to be on the market until Christmas, which is about two weeks later than what would have been predicted last year. While this may appear to be a long predicted wait in comparison to last year's inferno-hot circumstances, it's crucial to note that this time on the market is still far below pre-pandemic standards.

The costs payable to Building Regulations depends on the size of the unauthorised works; but will be in the £100s. For an exact cost you should...

Read More »

If your farm is 5 hectares or more, you have the right to erect, extend or alter a building. The types of permitted development include temporary...

Read More »

Markets expected to cool the fastest — with 77% of respondents expecting declines — are those that experienced the most growth during the pandemic, such as Boise, Austin, and Raleigh. The panel expects suburban and exurban areas to retain their heat over the next 12 months, while vacation and urban areas are expected to see price declines. Rent growth should remain strong in the short term as high home prices keep many would-be first-time buyers in the rental market. Over the next 12 months, rents are expected to grow more than inflation, stocks, and home values. The panelists predict an average of 5.4% rent growth throughout 2023 – lower than the 8.6% annual growth they expect to see by the end of this year, but still higher than what Zillow data show to be just under 4% annual growth in the years prior to the pandemic. According to some experts, the real estate forecast for the next 5 years shows that it will be a balanced market. Despite declining buyers' optimism that now is a good time to buy a house, the number of households interested in becoming homeowners remains high. This is especially true for younger homebuyers, who are likely first-time buyers and are struggling to save for a down payment as rents continue to reach record highs. Simultaneously, seller expectations for larger down payments appear to be increasing, fueled by a still-competitive housing market and repeat buyers with relatively more available equity. The housing market is unlikely to shift from a seller's to a buyer's market anytime soon. Rising mortgage rates may take some of the steam out of the market, allowing inventory to rise slightly. It would also slow the rate of home price appreciation and reduce the possibility of a red-hot housing market resulting in an overheated market. The supply of available homes is so low that even a significant drop in demand due to higher interest rates will not turn this into a buyer's real estate market, according to industry experts. Because there are not enough houses available to meet demand, home prices will continue to rise, but the combination of rising home prices and elevated mortgage rates means fewer people will be able to afford to buy. There would still be continuous price appreciation, scarcity of inventory, and good demand. Some markets will experience lower appreciation rates than others, with the Sunbelt performing particularly well. Home prices do not appear to be decreasing, even in some of the country's most expensive markets, the tier-one markets. CoreLogic expects to see a more balanced housing market, with year-over-year appreciation slowing to 3.9% by Sept 2023. The CoreLogic HPI Forecast indicates that home prices will increase on a month-over-month basis by 0.0% from September 2022 to October 2022 and on a year-over-year basis by 3.9% from September 2022 to September 2023. Nationally, home prices increased 11.4% year over year in September 2022. On a month-over-month basis, home prices declined by 0.5% in September 2022 compared with August 2022. No states posted an annual decline in home prices. The states with the highest increases year over year were Florida (23%), South Carolina (17.6%), and Tennessee (17.4%). Large cities continued to experience price increases in September, with Miami on top at 25.6%, followed by Phoenix at 13.8%, and Las Vegas at 13.6% year over year. The CoreLogic Market Risk Indicator (MRI), a monthly update of the overall health of housing markets across the country, predicts that Crestview-Fort Walton Beach-Destin, Florida is at a very high risk (70%-plus probability) of a decline in home prices over the next 12 months. Bremeton-Silverdale, Washington; Bellingham, Washington; Eugene, Oregon and Tacoma-Lakewood, Washington are also at very high risk for price declines in 2023. A worldwide research firm, Capital Economics, predicts that the U.S. house price rise will likely slow in 2023, not this year. In October, the firm revised its forecast from a 5% price decline to an 8% price decline. Moody’s Analytics also adjusted its insights in August, September, and October, estimating a steeper drop each month. The economic research firm now expects home prices to fall 10%, and that’s in a best-case-scenario. If a recession takes hold, prices could fall between 15% and 20%. However, the firm does not forecast a spectacular “price decline” or a housing bubble bust similar to that of 2006, which precipitated the global financial crisis and the Great Recession. A 5 percent fall would definitely constitute a price decrease, but it would not cause home prices to spiral out of control. Remember that house prices have risen steadily for several years and surged significantly during the COVID-19 epidemic. A price drop is noteworthy, but in the grand scheme of things, it is relatively little. Before the housing bubble of 2006, the U.S. housing market was primarily supported by exceedingly risky bank lending methods that produced a synthetic demand for housing, allowing those who could not afford to retain their homes to acquire them. According to analysts, today's market does not have the same circumstances. According to analysts, today's market does not have the same circumstances. Capital Economic forecasts that mortgage rates would increase to 6.5 percent by 2023. According to Matthew Pointon, a senior property economist at Capital Economics, if home price growth follows our earlier predictions and declines to zero by mid-2023, mortgage payments would remain above their mid-2000s peak until mid-2023.

Warmer in winter An excellent benefit of a potting shed is that - though the full glass of a greenhouse means you get a more powerful result in...

Read More »

He argues that situating parking spots at a 45 degree angle leads to an efficiency savings of 23%, because cars need to change their angle much...

Read More »

Aerogel is more expensive, but definitely the best type of insulation. Fiberglass is cheap, but requires careful handling. Mineral wool is...

Read More »

between 4 to 6 inches The bottom layer should be comprised of stone (6” crushed rock) or consider 6” recycled concrete. The ideal thickness of each...

Read More »