DIY Builds

DIY Builds

DIY Builds

DIY Builds

Photo: Karolina Grabowska

Photo: Karolina Grabowska

Combined with the effect of the Federal Reserve's interest-rate hikes, we expect inflation to recede back to normal in 2023 and thereafter. We forecast inflation to average 2.4% over 2022-26 as a whole (in terms of the personal consumption expenditures price index), only slightly above the Fed's 2% target.

One of the main things to know when planning barndominium plumbing is how the pipes are laid. Barndominiums are not built on traditional...

Read More »

In short, the must-have tools for woodworking include the following: Hand saws. Power saws. Planes. Sanders. Files. Hammer. Mallet. Drill. More...

Read More »

Inflation in 2022 is set to peak at its highest level in four decades, but we think there’s less cause for concern about inflation in 2023 and beyond. High demand has conspired with supply constraints to cause price surges in many industries, hitting energy and autos especially hard. But once these supply constraints eventually resolve, we expect the various price spikes to unwind in a deflationary rush. Combined with the effect of the Federal Reserve’s interest-rate hikes, we expect inflation to recede back to normal in 2023 and thereafter. We forecast inflation to average 2.6% over 2022-26 as a whole (in terms of the personal consumption expenditures price index), only slightly above the Fed’s 2% target. The year 2022 will deliver the worst for inflation (6.1%), but over 2023-26, we expect inflation to average just 1.7%.

Landscape fabric creates a barrier between the rocks and soil. When it comes time to remove the stones, you can quickly shovel them off the fabric...

Read More »

Excess water outside the shed must have an escape route away from the building. The foundation should contain a damp-proof membrane which should be...

Read More »

We're projecting large deflation in prices for durable goods, food, and energy over 2023-26. For durable goods, resolution of the semiconductor shortage should play a large role in expanding supply. A normalization of consumer spending mix will also shift demand away from durables (and other goods) and back into services. For food and energy, prices should subside as these industries adjust to disruption from the Russia-Ukraine conflict and other factors. We don't expect the price spikes in energy and durables to be replaced by new problems elsewhere in the economy. We expect moderate wage growth and the absence of any long-lasting supply disruptions to keep general inflation at restrained levels. Fed tightening will cool off the overall economy substantially in 2023 and 2024, extinguishing the inflationary fire before it spreads to the broader economy.

Metal Sheds Are Very Durable As a material, metal is always going to be more durable than wood, and the same is true of sheds. Metal is extremely...

Read More »

Peppermint oil, cayenne pepper, pepper and cloves. Mice are said to hate the smell of these. Lightly soak some cotton balls in oils from one or...

Read More »

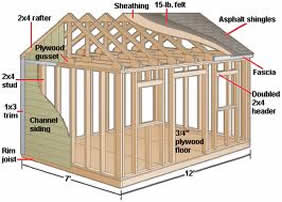

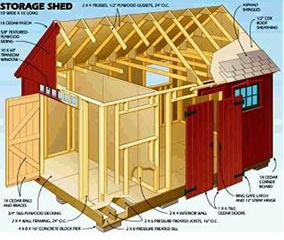

These are! They guide you every step of the way to complete your dream shed.

Learn More »Oil prices have skyrocketed as sanctions and boycotts have disrupted Russia's oil supply. Compensating for Russia will take some time, but we expect producers in the U.S. and elsewhere to steadily ramp up production until prices fall back to the marginal cost of production, which we assess at $55. The contrast with the 1970s’ oil-price shock could not be greater. Oil prices first tripled in 1973 and ended the decade up 11 times versus 1970 levels. There were short-run disruptions that contributed to that surge, but the long-term story was the awakening of OPEC’s market power, which never returned to the rapid production growth exhibited in the 1960s. Also, other cheap sources of crude had been tapped out by this time, necessitating a shift to offshore drilling and other, more-expensive sources. These kinds of secular drivers of higher prices explain why the 1970s’ oil shock never fully receded—but secular drivers aren’t at work in today’s oil price surge. There's been much discussion about whether the inflationary fire will spread to the housing market next. Housing prices have reached lofty levels. If they stay there, they will drive higher inflation over the next several years. However, we expect home prices to reverse course before they can add too much to inflation. The Fed’s interest-rate hikes have caused a sharp deterioration in home affordability, which is rapidly cooling off housing demand. As a result, we expect housing demand to drop 10% between 2022 and 2023, which will in turn drive a cumulative 8% drop in housing prices between 2022 and 2025. Of course, while falling housing prices equal good news for inflation, they will mean pain for homeowners who assumed prices would keep rising when planning out their personal finances.

As small as 2 feet: Bump outs may extend as far as 10 to 15 feet from the house, but they can also be tiny "pop-outs" that are no deeper than 2...

Read More »

As well as burglar chalk signs, burglars mark houses with almost anything they can; it may be a small blob of paint or a piece of string tied...

Read More »

Disadvantages of Wood Foundations Damage from rot and insects. If a wood foundation is properly built and the site is well-drained, a PWF can last...

Read More »

Paving a new driveway can add significant value to your property. You can definitely get a great return on your investment. At the very least your...

Read More »